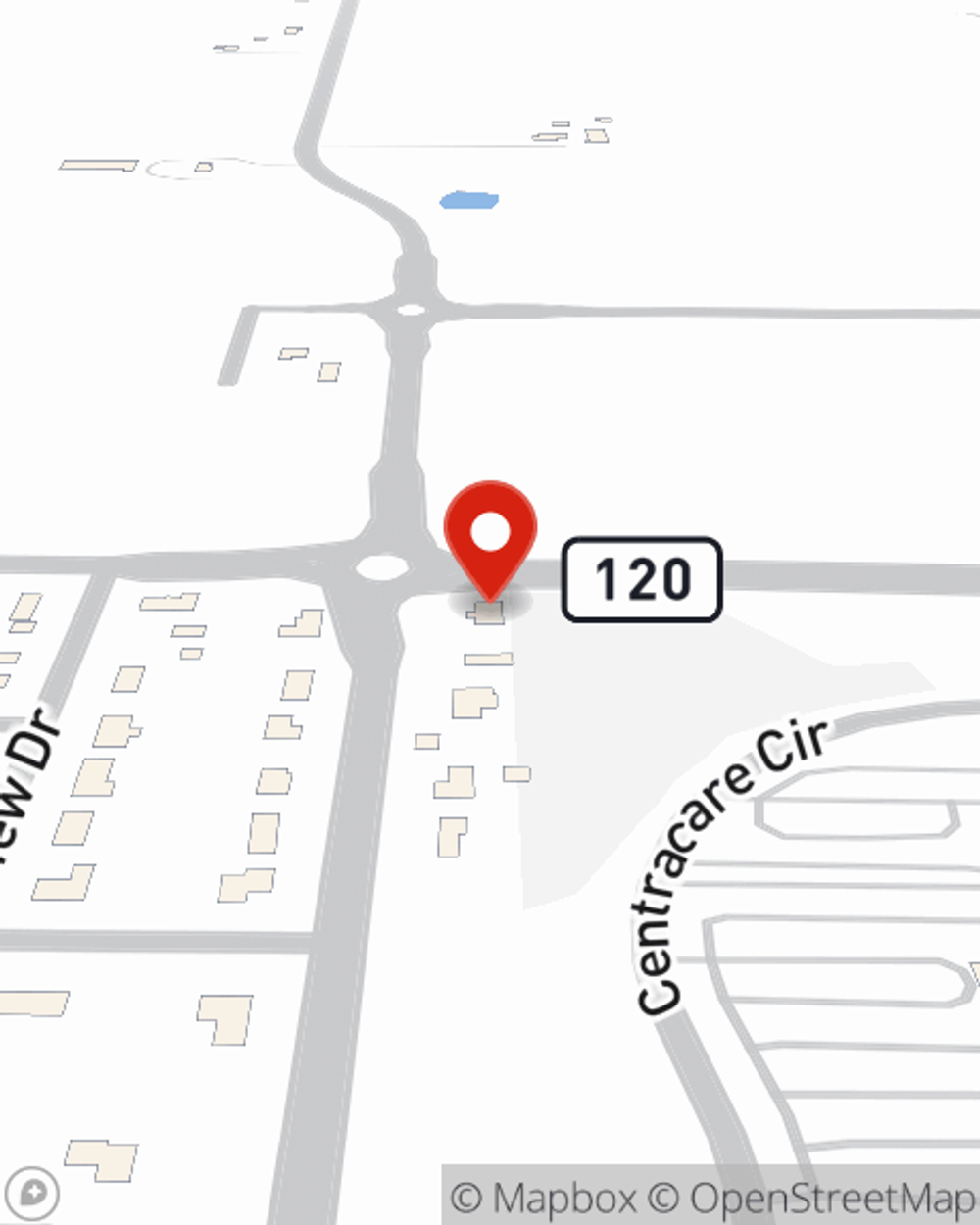

Business Insurance in and around St. Cloud

Researching protection for your business? Search no further than State Farm agent Kristen Stebbins!

Helping insure businesses can be the neighborly thing to do

Your Search For Remarkable Small Business Insurance Ends Now.

Small business owners like you have a lot on your plate. From marketing guru to financial whiz, you do as much as possible each day to make your business a success. Are you a home cleaning service, a barber or an optometrist? Do you own an interpreter, a music school or a tailoring service? Whatever you do, State Farm may have small business insurance to cover it.

Researching protection for your business? Search no further than State Farm agent Kristen Stebbins!

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Each business is unique and faces a different set of challenges. Whether you are growing a music school or a candy store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your layout, you may need more than just business property insurance. State Farm Agent Kristen Stebbins can help with worker's compensation for your employees as well as key employee insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Kristen Stebbins is here to help you discover your options. Call or email today!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Kristen Stebbins

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.